Make the “Right” Turn at 65

Here are the two most common paths people use to get Medicare coverage. Everyone’s situation is unique, and there isn’t a one-size-fits-all answer. That’s where we step in — to guide you through your choices, make the process simple, and help you avoid a wrong turn at 65.

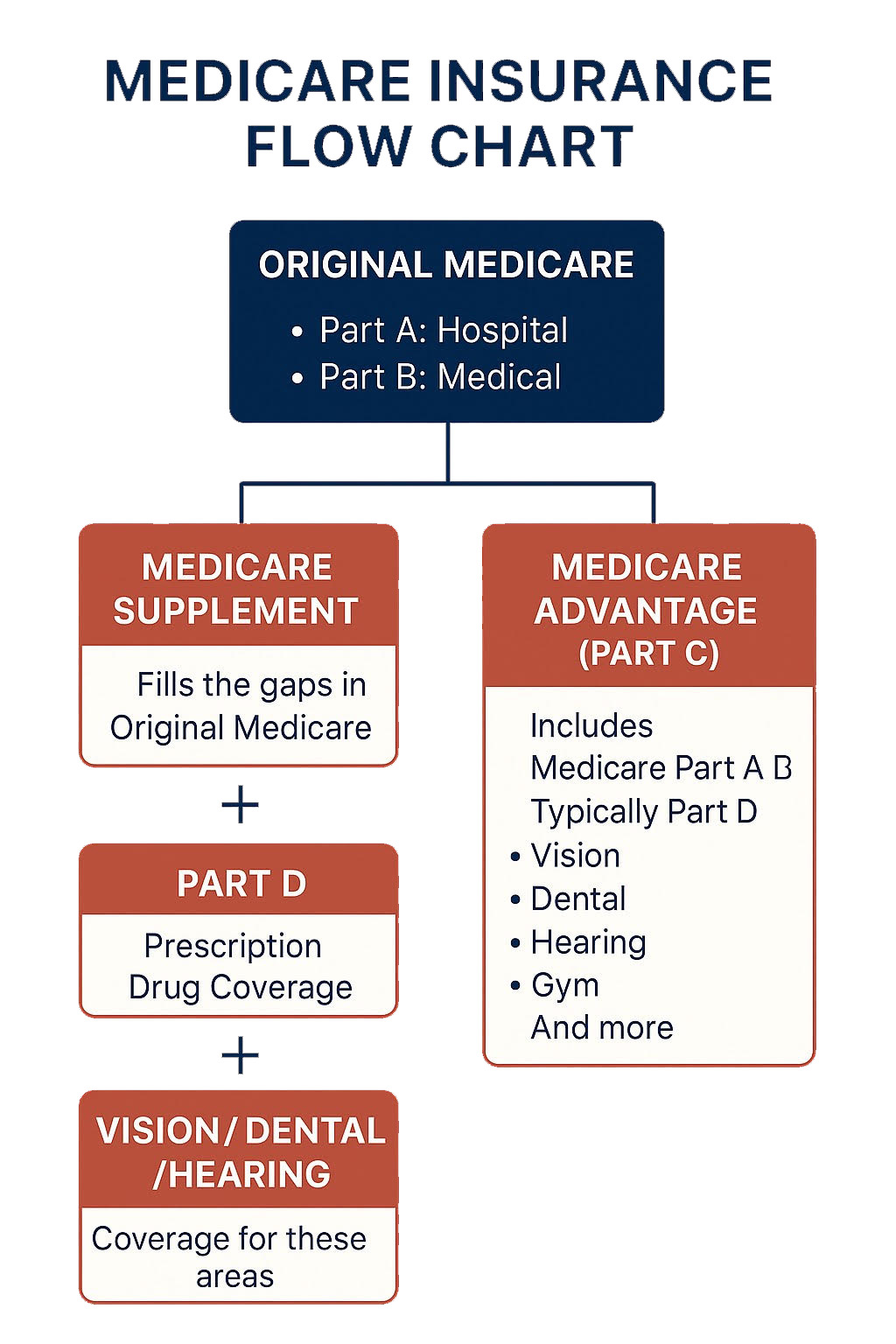

Understanding Your Medicare Options

1. Medicare Advantage (Part C)

-

Combines Medicare Part A & Part B into one plan.

-

Usually includes drug coverage (Part D) and extra benefits like vision, dental, hearing, gym, and more.

-

You can review and adjust your Medicare Advantage plan each year during the Annual Enrollment Period (October 15 – December 7).

2. Medicare Supplement (Medigap) + Separate Plans

-

Works with Original Medicare (Part A & Part B) to cover costs that Medicare doesn’t pay, like copays, coinsurance, and deductibles.

-

You must also get a separate Prescription Drug Plan (Part D).

-

If you want extra coverage, you can add standalone vision, dental, and hearing plans.

Important: Outside of your initial Medicare eligibility window or special situations (like retiring after 65 and leaving employer coverage), if you want to enroll in or switch Medicare Supplement plans, you generally have to go through medical underwriting. This means the insurance company can ask health questions and may deny coverage or charge more based on your health history.